Puzzled by the new UK Car Tax System? Wondering why the government have decided to make more changes since last year?

Well, while we cannot explain the latter, our comprehensive guide highlighting where the new tax rules have changed should provide you with everything you need to know.

In April of last year, the government changed the bandings on exercise duty, affecting all new car buyers.

With some researchers pointing the finger at the changes as the reason to the drop in new car sales, the government has remained resolute in continuing their increases, applying further reforms due on the 1st April 2018.

The changes brought about in April 2017 specifically targeted diesel and petrol cars, with exceptions for zero emission and electric vehicles – providing they are under the value of £40k. A blanket fee of £140 per year was applied to all of the vehicles that didn’t meet those exemptions, with the vast majority of vehicles jumping into increased bands as well.

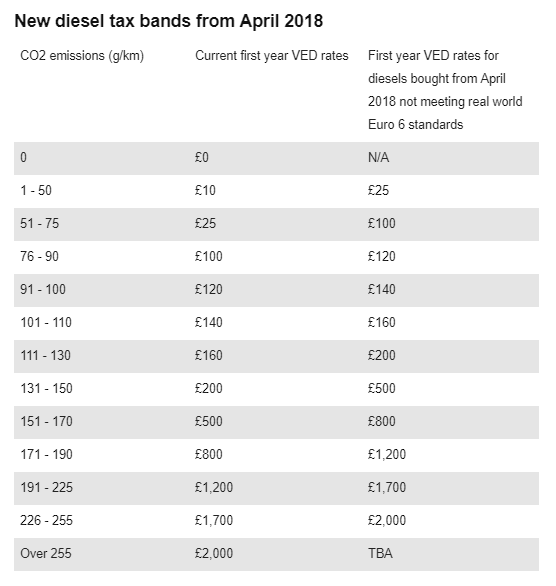

But in November 2017 following the Autumn Budget, Chancellor Philip Hammond announced that new diesel cars bought and registered after 1st April 2018 would see further alterations. The changes essentially propose that all diesel cars which fail to meet the Euro 6 emission standards in both Laboratory and real-world tests will face higher rates.

The Treasury however estimates that there will be less than 2 million vehicles effected by the changes, but cars like the Porsche Cayenne are expected to see their first year tax increase by up to £500 per year, along with other high powered, prestigious vehicles.

The table below details all of the pending changes:-

With many of our customers prestige car leasers, the effects will unfortunately filter down and appear in our rentals. Although this will be true of any leasing agent or provider, it is with a heavy heart we break this news to you.

If you are in the market for a prestige vehicle and you are concerned about the potential increase in rental, feel free to give us a call. It's important to bear in mind that these changes have not yet taken affect, so anything ordered and registered pre-April 2018 will not qualify for any of the changes.

Call us now on 0161 434 4321 or check out our latest leasing offers.

Looking for a deal on your next vehicle?

Check out our special offers or give us a call on 0161 434 4321